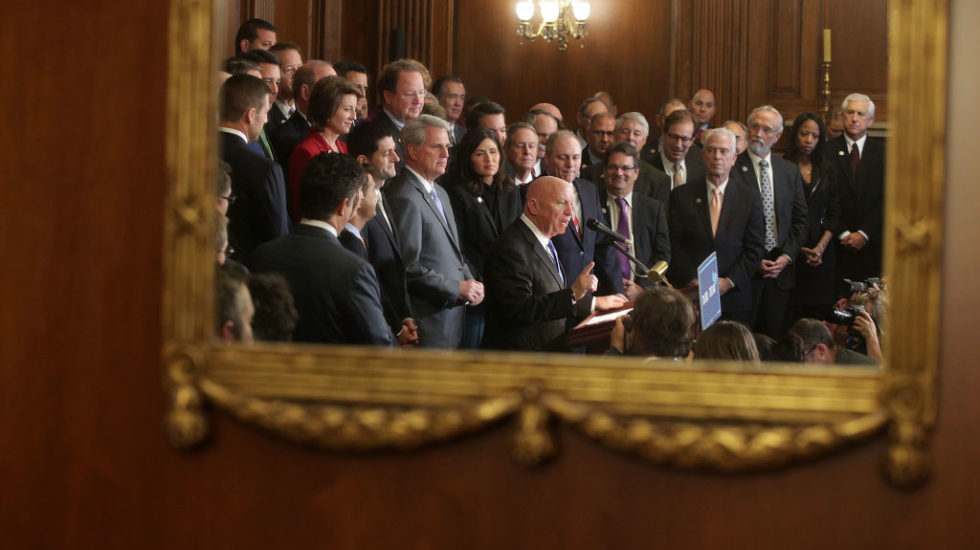

We’re not fans of all caps but THIS IS HUGE. And, you should PAY ATTENTION. The House just passed its version of the trillion dollar tax reform along straight party lines. Not one Democrat voted for it. Thirteen Republicans also voted no. But the GOP majority was still large enough for it to pass.. The bill was rammed through in just two weeks with zero hearings. Now it goes to the Senate where its version of the bill is less certain to pass. It will be close. Here’s the headline: For tens of millions of middle class Americans, you will have a tax increase. If you’re wealthy, congrats! You won’t. This is how The Washington Post characterized it:

If you’re one of those white working-class voters who propelled Donald Trump into the presidency and gave Republicans total control of Washington, the GOP has a message for you: Sucker!

Yep, remember all those promises from the campaign trail? Donald Trump said he would lower taxes for everyone. If this passes as is, that will be a(nother) lie. And if you were to receive a tax cut, it will be temporary. That’s not the case for corporations. Those will be permanent. The idea is that big companies will use all these savings on investing in their businesses and hiring employees, the economy will expand offsetting the loss of revenue from mega corporate tax cuts. This piece from Vox argues that isn’t going to happen.

Corporations are flush with cash from large profits and aggressively low interest rates, yet they aren’t investing. This is a big hint that large tax cuts for corporations will have very little effect on the economy. They’ll only amplify the deleterious trends we’re still struggling to understand.

All eyes are now on the Senate. Much is in flux. Right now, the middle class loses. Corporations win. The wealthy win. And one of the biggest winners of all is the guy who once said of tax reform, “It’s not good for me. Believe me.” NBC News is reporting the Trump family could save $1 billion under the House plan.